Factors that directly affect stock market

Movements in the stock market can be very unpredictable and some of the time developments in share price can appear to be separated from financial components. Nonetheless, there are underlying factors which have a high impact on the development of share price and the stock market in general.

Underlying Factors Affecting the Stock Market

Economic Strength of Market

Company stocks lean to follow with the marketplace and with their segment or industry peers. Some firms contend that the mix of general market and section developments instead of an organization’s single execution determines a larger part of a stock’s development.

Liquidity

Liquidity is a vital and sometimes undervalued factor. It refers to how much an investor interest and consideration a specific stock has. Exchanging volume is an intermediary for liquidity, as well as a component of corporate correspondences that is, how much the organization is getting consideration from the financial specialist group. Huge top stocks have high liquidity: they all around take after and intensely executed. Some little top stocks experience the ill effects of a practically lasting “cash rebate” since they are not on financial specialists’ radar screens.

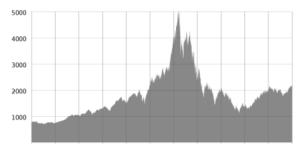

Trends

Often a stock mostly moves as indicated by a fleeting pattern. From one perspective, a stock that is moving can assemble momentum, and popularity floats the stock higher. Then again, a stock at times carries on the inverse path in a pattern and does what is called returning to the mean. Sadly, because patterns cut both ways and are more evident looking back, realizing that stocks are attractive does not help us foresee what’s to come.

Often a stock mostly moves as indicated by a fleeting pattern. From one perspective, a stock that is moving can assemble momentum, and popularity floats the stock higher. Then again, a stock at times carries on the inverse path in a pattern and does what is called returning to the mean. Sadly, because patterns cut both ways and are more evident looking back, realizing that stocks are attractive does not help us foresee what’s to come.

Lower interest rates

Blower interest rates can make shares more appealing for two reasons. It helps commercial development making firms more productive. Additionally, lower loan fees make stocks more alluring than sparing cash in a bank or holding bonds. If security yields fall, it might urge financial specialists to switch into shares which give a moderately better profit.

Internal Developments

Internal factors or advancements within a company, for example, innovation products, mergers, acquisitions, overall execution and suspension of profits to give some examples will influence the cost of its stock. A company that has great administration, steady returns and excellent development prospects will be in all likelihood draw in speculators which increment the interest for its shares.

Then again, a negative company will bring about the decrease of its share cost. Stock prices rely on upon the present status or the performance of a company.

These said variables are outside one’s ability to control. Watchfulness and mindfulness can increase the chances of saving wealth in the stock exchange. The best thing that financial specialists can do is to keep updated on economic and political events happening around the world. Check out Bovespa and have your investment grow.

These said variables are outside one’s ability to control. Watchfulness and mindfulness can increase the chances of saving wealth in the stock exchange. The best thing that financial specialists can do is to keep updated on economic and political events happening around the world. Check out Bovespa and have your investment grow.